Central Bank Digital Currencies (CBDCs): A Beginner’s Guide

Central Bank Digital Currencies (CBDCs): A Beginner’s Guide. Central bank digital currencies are issued and supported by a central bank. The rising demand for cryptocurrencies and stablecoins has forced central banks worldwide to diversify their revenue streams away from fiat currency—digital cryptocurrencies number in the thousands. Facebook’s Diem project shows that the government doesn’t issue cryptocurrency despite its centralization. However, Bitcoin and other decentralized cryptocurrencies exist.

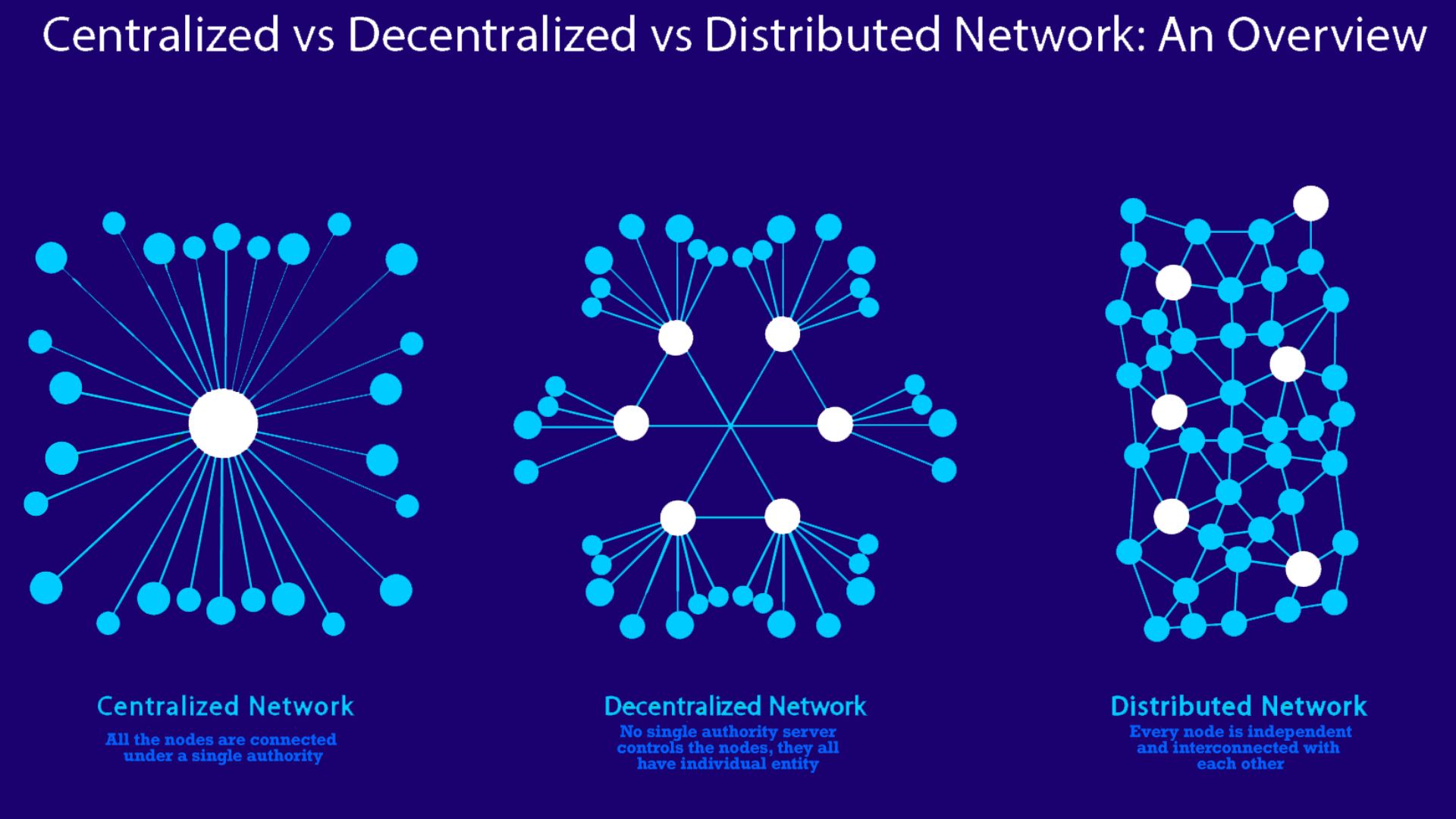

Coins use distributed ledger technology (DLT), which uses a global network of computers to validate transactions without a central authority. Using a blockchain or other digital record, CBDC secures payments between individuals, institutions, and banks. Digital currencies issued by national banks are transforming international finance. The Crypto vs. CBDC dispute has puzzled many. CBDCs will be conceptually compared to cryptocurrencies and central bank digital currencies in this article.

What are CBDCs?

Cryptocurrencies are promoted for streamlining financial services infrastructure and enabling global financial inclusion. However, their value storage, not commerce, is its most famous use. The gap narrows as monetary authorities and businesses adopt stable cryptocurrencies and CBDCs as mainstream payment options. Digital currency—an alternative to traditional money based on computer assets—has been known for over 25 years. Central agencies issued the first digital currencies, DigiCash, in 1989 and e-gold in 1996. However, the 2009 launch of Bitcoin created a widely traded currency independent of any sovereign monetary authority and a decentralized (blockchain-based) ledger for transaction execution and record-keeping.

CBDCs have become more popular because of the COVID-19 epidemic, digital payments, hopes to use foreign CBDCs in international transfers, and financial exclusion concerns. Thus, the world’s strongest central banks are racing to develop the first real digital currency. In China, a digital Renminbi for mobile phone payments is being tested.

Europe’s five-year plan also called for a digital euro. The epidemic accelerated contactless payments, emphasizing the need for safe, fast, and cheap payments for all. Tech platforms add private digital money to the US payment system, while international regulators scrutinize CBDCs for cross-border payments. In response, the Fed is speeding up CBDC research and public involvement.

According to public statements, CBDCs appear to be more than digital copies of traditional currency. Some governments restrict the usage of CBDCs to specific places and times or need to implement monetary and social policies. CBDC architectures vary, affecting payment systems, monetary policy transmission, and financial system stability and structure.

The Money Flower

A “money flower” is a Venn diagram depicting a monetary taxonomy. It primarily focuses on the interplay between four main parts:

-

Issuer (central bank)

-

Form (digital or physical)

-

Accessibility (general or restricted)

-

Technology (token or account-based)

One of two technologies—stored-value tokens or accounts—is typically the basis for money. Tokens underpin cash and a plethora of digital currencies, whereas accounts underpin the majority of commercial bank money and reserve account balances.

One crucial distinction is the verification needed to exchange tokens compared to account-based money. For token-based funds to work, the receiver must be able to verify the authenticity of the payment item. Conversely, confirming the account holder’s identity is crucial to account money systems. The digital currency of central banks is the blossoming flower’s focal point. Based on taxonomy, CBDCs can be categorized into three distinct categories (the shaded area in dark grey). You can choose between an account-based form and a token-based one.

Depending on the intended usage of the CBDC in the future, the two token-based versions differ regarding who gets access. It is a popular form of payment with several potential uses, one of which is in retail purchases. The second one is a digital settlement token that can only be used for specific wholesale settlement and payment transactions. As clarified later, these tokens are known as general-purpose or wholesale-only tokens.

Types of CBDCs

The payment, clearing, and settlement processes could benefit greatly from establishing a general-purpose or wholesale-only CBDC.

General-purpose CBDCs

A “general-purpose CBDC” is intended for public distribution. Elements of DLT-based retail CBDC include anonymity, traceability, availability around the clock, and the possibility of an interest rate application. Emerging market central banks aim to reduce currency printing and handling costs, increase financial inclusion by accelerating the transition to a paperless society, and take the lead in the rapidly expanding fintech industry. As a result, this proposal is gaining momentum.

Wholesale only CBDCs

Banks that maintain reserve deposits with a central bank are eligible for a wholesale CBDC. It can potentially lessen the risks associated with counterparty credit and liquidity while improving the efficiency of payment and security settlements. A value-based wholesale CBDC could substitute for or add to central bank reserves using a restricted-access digital token. The sender and receiver could interact directly with a token, cutting out middlintermediariese. It is a bearer asset.

The present system differs from this proposed change because the central bank would move money rather than just debiting and crediting accounts. Central banks favour wholesale CBDC because they can improve existing wholesale financial systems more rapidly, cheaply, and securely. In the last section, we covered the many types of CBDCs or central bank digital currencies. See the infographics below for a rundown of what differentiates wholesale CBDCs from retail ones.

Which Countries Have a CBDC?

Before COVID-19, digital currencies issued by central banks were mainly academic exercises. But central banks quickly realized they couldn’t afford to ignore the changing nature of money, with the need to spread massive fiscal and monetary stimulus around the globe and the emergence of cryptocurrencies. To construct a CBDC, 81 nations with a combined GDP of over 90% were evaluated, as reported by the Atlantic Council. In May of 2020, just 35 countries were considering a CBDC.

China is getting a head start on the competition by letting international athletes and spectators submit their passport details to the People’s Bank of China using digital Yuan. The Federal Reserve System of the United States lags well behind the other major central banks, including the ECB, BoJ, and BBofE. Five countries have now fully launched their digital currencies. The first CBDC to be commercially spread was the Bahamian Sand Dollar. Major economies such as South Korea and Sweden are among the fourteen countries presently conducting pilot tests of CBDCs in preparation for a full rollout.

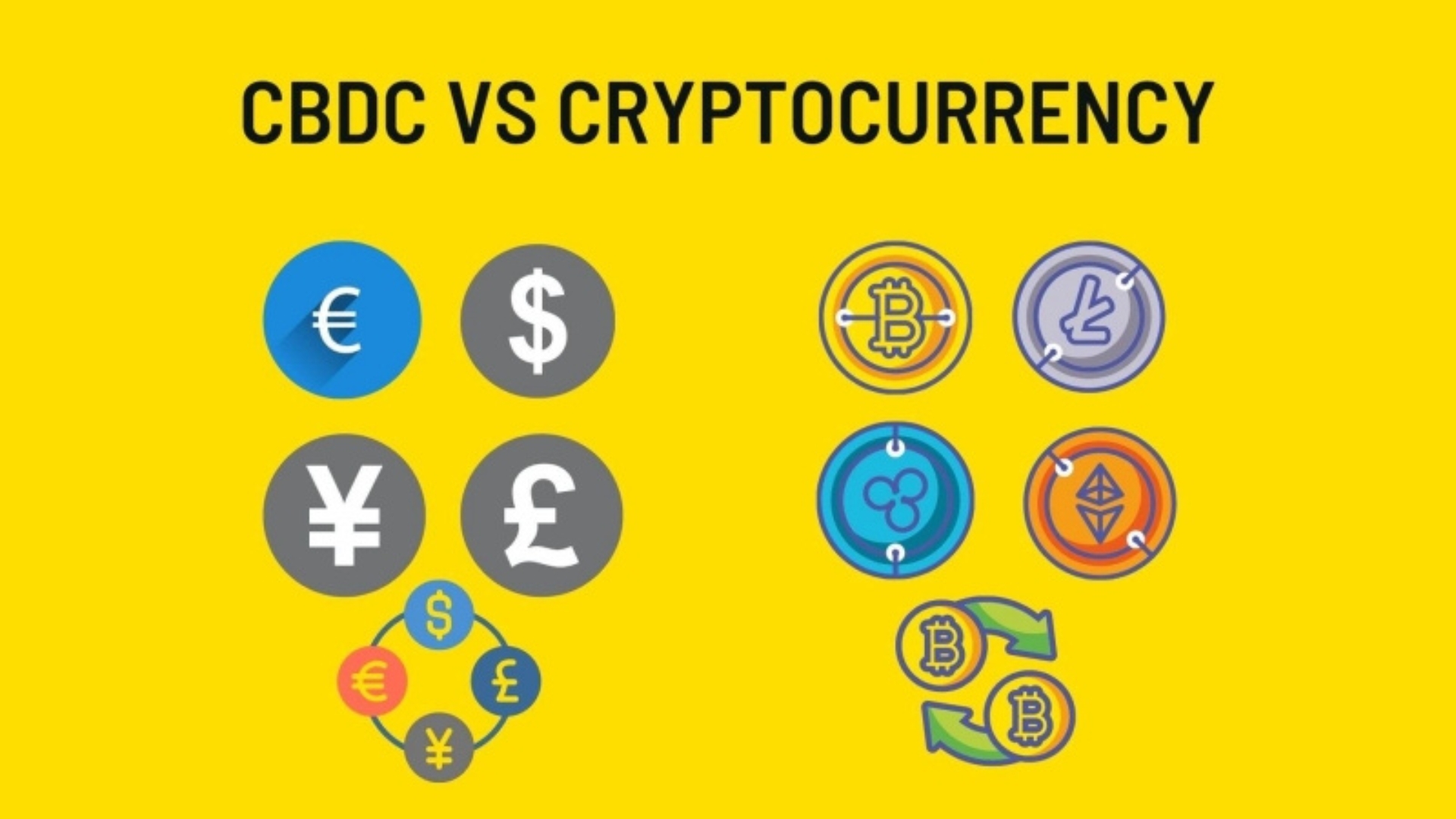

CBDC vs Cryptocurrency

Many people confuse digital currencies issued by governments with other forms of cryptocurrencies. Previous discussions established that central banks are integral to all transactions involving digital currencies issued by these institutions. On the other hand, digital tokens produced by a distributed network or blockchain employing cryptographic techniques are known as cryptocurrencies.

Cryptocurrencies employ permissionless blockchains, while CBDCs use private ones. Public blockchains allow anyone to join and participate in core tasks. Since anybody may access, modify, and verify the transactions on a public blockchain, it functions autonomously. A private blockchain is a decentralized distributed ledger that acts as an encrypted database.

The CBDC networks are subject to the regulations imposed by the central bank. The user base on crypto networks determines things by achieving a consensus, which gives them authority. So, CBDCs are centralized, unlike decentralized cryptocurrencies. Also, whereas CBDCs let central banks see who owns what, cryptocurrencies offer anonymity. Coins decentralized on blockchain are more common than CBDCs, which are more likely to operate on separate technological platforms.

Unlike stablecoins, the dollar is not a fiat currency that CBDCs are bound to. CBDCs lack anything to do with traditional currencies; they work like them. Example: A CBDC $1 currency has the same face value as a dollar bill. CBDCs can only be bought, not hoarded or invested. However, cryptocurrencies are used for financial transactions and speculation.

CBDC data and privacy are less critical than cryptocurrencies. While central banks are subject to regulation, the peer-to-peer cryptocurrency industry functions autonomously. Because cryptocurrencies are decentralized, users can choose how much and what data to reveal. Contrary to popular opinion, CBDC transactions automatically send significant data to tax and regulatory organizations.

How are CBDCs Different from Bitcoin?

Although Bitcoin is the most talked-about cryptocurrency and the first to achieve broad acceptance, thousands of other crypto assets are out there. The appearance of several crypto variations has not diminished the allure, practicality, or ideals of Bitcoin. On the contrary, the ecosystem is doing better now thanks to the proliferation of stablecoins, CBDCs, and other uses for blockchain technology and cryptocurrencies.

Central Bank Digital Currencies: The Bitcoin ecosystem provides a window into a potential future financial system free of cumbersome legislation that dictates the terms of transactions. An example of a cryptocurrency is Bitcoin, which has grown in popularity since its 2009 inception. Bitcoins are not physical currency that can be exchanged. Instead, all parties involved trade and record their transactions in a publicly accessible, encrypted ledger. In theory, the mining process could verify any transactions. Bitcoin has no backing from governments or banks.

The intended use case for CBDCs is to replace fiat currencies. In theory, customers would have access to both the safety and convenience of digital payment systems and the regulated, reserve-backed circulation of more conventional banking systems. They have three primary functions: a medium of trade, a unit of account, and a means of storing value. CBDCs, similar to fiat money, will have the full faith of the issuing government behind them. Monetary authorities or central banks will bear full responsibility for their actions.

Pros and Cons of Central Bank Digital Currencies

Pros

CBDCs aid monetary policy and government functions. Retail or general-purpose CBDCs connect consumers directly to central banks, whereas wholesale CBDCs facilitate bank transactions. Digital currencies can also streamline government processes like benefit distribution, taxation, and collection. Every intermediary-based financial transaction entails third-party risk. What if a financial crisis or rumour prompted a bank run? These can disrupt monetary equilibrium. The central bank absorbs systemic risk in a CBDC, eliminating the requirement for a third party.

CBDC systems calibrate privacy. A value-based retail CBDC protects consumers’ data by providing transaction anonymity. CBDCs with accounts work like bank accounts and may have privacy features. Because CBDCs are digital and aren’t possible by serial numbers, they can help stop crime. Using cryptography and a public ledger, a central bank that tracks money across its region can easily prevent criminal conduct and CBDC transactions.

Financial inclusion is problematic for large parts of the unbanked population, especially in developing nations, due to the high cost of banking infrastructure. CBDCs connect consumers directly to central banks, bypassing expensive infrastructure.

Cons

CBDCs aren’t a panacea for decentralization issues in every case. Still, a centralized authority (the central bank) has the delegation and ownership of the power to perform transactions. This means it continues impacting the data and transaction levers people and banks use. People would have to give up some privacy if the administrator collected and distributed digital IDs. The service provider would be able to see all transactions. This may cause problems with user privacy comparable to those that large IT companies and ISPs have encountered. Central banks could block transactions between citizens, or criminals could hack and abuse information.

CBDCs facilitate international and cross-currency payments that are not time-sensitive or affected by holidays or other local events. The other side is that different regulatory and legal frameworks significantly hinder cross-border payments. Integrating these models would be difficult. CBDCs might cause unanticipated consequences on currency markets. One example is China’s central bank digital currency (CBDC), which aims to compete with the dollar. If the digital Yuan becomes the principal payment instrument in China, international corporations will be compelled to utilize it for transactions, which could impact the dollar’s function.

Future of CBDCs

Because CBDCs would destabilize the fractional reserve system, commercial banks could lend out more money than they have in liquid deposits, effectively creating money. Banks can’t lend money or make investments without deposits. If all private bank deposits were moved into CBDCs, traditional banks would have little choice but to transform into “loanable funds intermediaries,” taking out long-term loans to support other long-term loans, such as mortgages.

Restrictive banking under primary central bank supervision will replace the fractional reserve system. If that happened, there would be many benefits to what would amount to a financial revolution. Central banks need to step in to prevent bank runs and keep an eye on private banks’ risky lending and credit choices.

An optimally crafted CBDC will serve as a neutral and safe asset for payments and settlements, facilitating the new payment ecosystem’s ability to work together on a standard, interoperable platform. As a result, a more open and competitive system of available finance will be possible. It will also keep the currency under democratic control.