Blockchain: A Comprehensive Guide 2024

Blockchain: A Comprehensive Guide 2024. The data recorded on a blockchain cannot be altered or hacked because of this technique, which is why it is called a blockchain. Distributed ledger technology (DLT) encompasses this system, which allows for the simultaneous recording of transactions and associated data in numerous locations. To avoid a central point of failure, every computer in a blockchain network keeps an identical copy of the ledger that records transactions. Furthermore, all versions undergo simultaneous validation and updates.

Although it has the same category as databases, blockchain technology stores and maintains data differently. Blockchain technology has replaced the conventional database structure of rows, columns, tables, and files with digitally linked blocks. Furthermore, unlike traditional databases controlled by a single server, blockchains are decentralized and run by computers connected to a network of peers. In 2009, the Bitcoin blockchain introduced Bitcoin, the first cryptocurrency and widely used application to utilize blockchain technology effectively. Since Bitcoin and similar cryptocurrencies employ public ledgers, the term “blockchain” is typically considered Bitcoin and its equivalents.

What is Blockchain?

A blockchain is a decentralized database that stores data in discrete units called blocks linked by elaborate cryptographic protocols. Thanks to this, the data security kept on the Blockchain is practically impregnable. This is because tampering with data in one block would ruin data in others, making it very clear that someone has attempted to alter it. The immutability of blockchain technology makes it impossible to manipulate. Data that has already been recorded can only be updated, not changed in the past. A timestamp makes it possible to track any given data, verify it at any moment, and use it as a digital fingerprint. Blockchain has a few more unique features than other, more conventional databases. Many see these as the three cornerstones of blockchain technology.

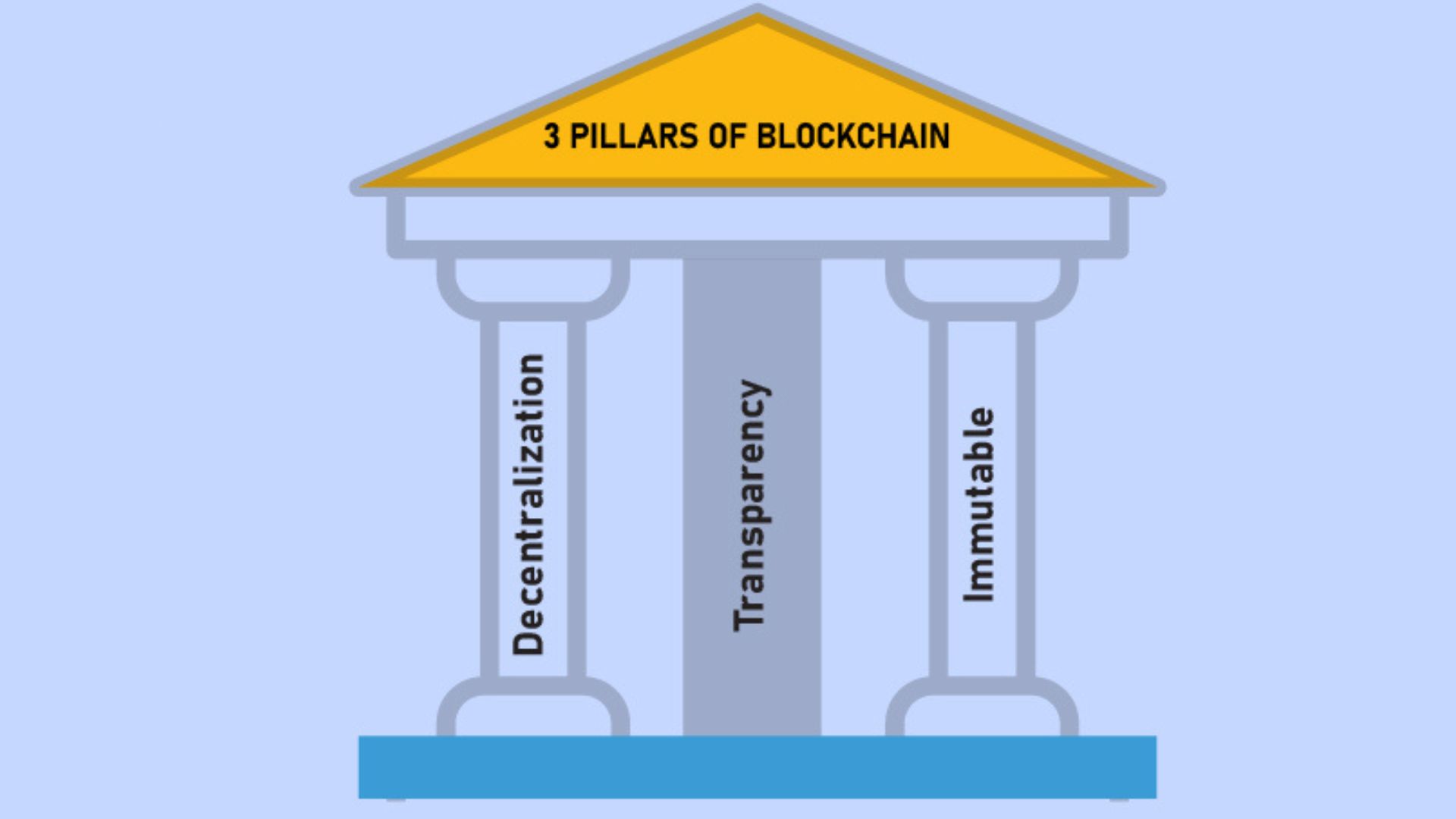

The Pillars of Blockchain

Blockchain has three main characteristics:

- Immutability

- Decentralization

- Transparency

They are the building blocks of blockchain technology and ensure the security of any cryptocurrency constructed on top of it. To state that these ideas are fundamental to blockchain technology would be an understatement. Now, we’ll examine each one in turn.

Immutability

It cannot be modified once something has been formed, called immutability. It is impossible to change a block once it has been added to the Blockchain; this is its characteristic. Hashing is the procedure that makes the Blockchain immutable. The process of hashing data produces a predetermined result known as a checksum. As a digital signature, the fact that the output is consistent whenever the same algorithm is used to hash the same data is essential. You can’t take a hash and acquire the information used to build that hash; this is the primary advantage of hashing.

The data from a blockchain’s most recent and prior blocks are combined to get the hash. Because of this connection, data in other blocks becomes useless if an attempt is made to alter data in one block, as this changes all hashes. The Blockchain refuses to accept the modification since the hashes are no longer valid.

But this ensures that the data remains intact. You can trust that data recorded on the Blockchain has not been altered over time, so you can utilize it whenever you need. It is possible to change information. However, doing so adds it to a new block. This prevents fraud and guarantees that its history can be accurately traced. It offers impartial information and can prove who did what and when which is helpful in fraud trials. A mistake maker cannot hide their tracks on the Blockchain, even though it doesn’t guarantee its integrity.

Decentralization

The decentralization process entails shifting power and responsibility away from a centralized entity to all individuals involved. This ensures that no one can unilaterally assume control of a blockchain. There is complete parity among all participants.

This won’t work so well in practice. People’s capacity to assume multiple personas to improve their decision-making skills are essential factors. A Sybil attack is the name of this famous manipulation technique. Your impact in a blockchain network depends on other elements, allowing you to avoid such risks while maintaining user anonymity. Different algorithms, like Cardano or Ethereum 2.0, use coin holdings, while Bitcoin uses processing power.

There are several benefits to decentralization:

- Peer-to-peer communication: there are no intermediaries in a decentralized system. If you want to send someone money through the Bitcoin network, you do so directly instead of through a third party, such as banks and other centralized financial services.

- Security: since the data isn’t stored in a single spot but is shared among all participants, you can’t hack a blockchain.

- Data reconciliation: with all the data in one place and distributed among participants, any incorrect data (either through an honest mistake or as a malicious attempt) can be quickly recognized and corrected.

- Efficiency: if one node or participant has to update their system or their power has gone out, the network can continue as usual. This is because it does not depend on one person or group.

- Trustlessness: thanks to all the previous factors and Blockchain’s immutability, you don’t have to know anyone else in the network to know it will function well.

These benefits fit into each other and create Blockchain’s famous environment that strives for fairness and equality.

Transparency

Since the Blockchain retains all data unchanged, every one may see much of it. Block explorers allow anyone to observe all associated data and transactions, making transparency the third pillar of the system. But that doesn’t imply that the person or business responsible for this data can be easily located. Bitcoin users, for instance, are under no need to divulge any personally identifiable information to third parties (crypto exchanges being an entirely separate animal). Each wallet has its unique address, recorded in the block whenever money is transferred to or from it.

I want to clarify that “hard to trace” is not the same as impossible. Exchanges are only one example of a blockchain-using business that publicizes wallet addresses, allowing anybody to view their transactions. This is crucial because it introduces a degree of responsibility previously unimaginable before Blockchain.

When it comes to people, the same is true. Your name and other personal information will be associated with your exchange wallet address if you have completed the Know-Your-Customer (KYC) process during registration. Despite this, the Blockchain itself will not display this data. Still, the exchange might make information available through hacks and other breaches or as part of a regulatory process (such as when you’re accused of malicious conduct).

How Does Blockchain Work?

To grasp the inner workings of Blockchain, one must be familiar with its foundational principles. We have previously proven it is a decentralized, transparent, and immutable database. Because it is accessible to all participants, it can be said to be spread. So, here’s what occurs when you wish to make a change, like sending a friend some Bitcoin:

- You create a transaction. You add all the relevant information, like who receives the BTC and how much.

- You pay the network fee. This is part of the miners’ reward for including your transaction in the next block.

- Your transaction is added to a block. This block is created by the participant who won the right to do so, depending on the consensus algorithm (miners, validators, etc.). The bigger your network fee, the more likely you will be included before others, so your transaction might go through faster.

- The block is added to the Blockchain. It goes through the aforementioned hashing process first. Once the block is added, you can’t change it anymore (which also means you can’t reverse your transaction unless the recipient decides to send you your funds back).

The process of adding a block to the Blockchain depends on another factor called a consensus algorithm. They are used to decide which participant gets to add the following block (and receive the rewards). There are several different consensus algorithms, but two of the most common ones are:

- Proof of Work (PoW): used by Bitcoin, it involves solving a puzzle (also known as “mining”), and the first participant or miner to solve the puzzle and let everyone else know is the one who adds the block and receives the reward.

- Proof of Stake (PoS): used by the upcoming version of Ethereum, the participants who get to make decisions are known as validators and are chosen by the number of coins they hold. Validators must stake a portion of the coins they own to be selected to add a block and receive the reward, and if they try to act maliciously, they forfeit their stake.

A participant in the network is also called a node. There are three main types of nodes:

- Light Clients keep only a shallow copy of the Blockchain, which includes only the basic information that they might need, as the Blockchain itself tends to get very big;

- Full Nodes are those that keep a full copy of the Blockchain and thus have access to all the information stored on it, regardless of size and

- Miners or Validators are nodes that can get the right to verify transactions, depending on the network’s consensus mechanism.

Who Invented Blockchain

The initial Blockchain, developed by an anonymous individual or group named Satoshi Nakamoto, was released in 2009 and served as the foundation for Bitcoin. Nonetheless, in 1991, scholars Stuart Haber and W. Scott Stornetta were the first to outline it over twenty years prior. Over the following eighteen years, Blockchain was able to see its first practical use thanks to additional technical breakthroughs (such as Stefan Konst’s theory of cryptographically protected chains from 2000).

Some believe that blockchain technology became independent of Bitcoin in 2014, and since then, it has been called blockchain 2.0. This signifies that it is used for reasons other than Bitcoin after that point, initially for other cryptocurrencies and subsequently for different applications.

Public vs Private Blockchains

Our entire tutorial has focused on so-called public blockchains and their unique characteristics. Anyone can join these blockchains and become a node without interference from any central authority because they are permissionless. However, the rise of blockchain 2.0 necessitated its usage by certain businesses for internal operations. The majority of the time, there is no compelling need for the public to have access to the data kept on the company’s Blockchain. Thus, the origin of private blockchains.

A private blockchain is not accessible to the general public, as the name suggests. These are typically held in high regard by the company and its associates. For instance, blockchain access is restricted to those directly connected to the tracked shipment in the supply chain sector. Given the potentially sensitive nature of the information held on the Blockchain, it must remain inaccessible to the broader public. A permission model is also standard in private blockchains. That is to say, someone in charge (often the company’s manager) can decide who can edit the Blockchain and view the recorded data. The lack of decentralization is usually the reason why these blockchains aren’t.

How to Invest in Blockchain Technology

There are two main ways to invest in blockchain technology:

- Through cryptocurrencies: buying cryptocurrencies means participating in the Blockchain. When the blockchain network introduces a new concept, improvement, or significant change, its coin price often follows. Not only can you generate an income this way, but owning decent amounts of specific cryptocurrencies also gives you voting rights in the Blockchain. This is not dissimilar to owning stocks.

- Through stocks: You can also invest in stocks of established companies with blockchain solutions as part of their offer. These are often lower-risk options. You can also invest in blockchain startups that have gone public.

Crowdfunding (initial coin offerings, or ICOs), Blockchain penny stocks, and venture capital are other methods to invest in Blockchain. You can choose which one you go with and how much money you’re ready to lose.

How to Use Blockchain

The procedure for utilizing blockchain technology for digital currency is straightforward. Sending money is as simple as gathering the recipient’s address, entering it into your wallet’s Send feature, deciding on a network charge, and waiting for confirmation. Funds are sent to you automatically, so there’s no effort required on your part. Access to the Blockchain’s block explorer is needed to utilize the Blockchain to trace information stored on it. For Bitcoin, the most popular block explorer is Blockstream.info, and for Ethereum, it’s Etherscan.io. All Ethereum coins use the latter, making it an all-encompassing Ethereum hub.

The type of Blockchain determines how one might become a participant in decision-making using blockchain technology. With proof-of-work (PoW) blockchains, you’ll need to shell out a tonne of cash for power and mining gear. Staking a portion of your native token is required in proof-of-stake (PoS) networks; therefore, you should aim to own a decent proportion of it. Check the network’s documentation for more detailed information; it usually explains everything you need.

Blockchain Use Cases

Blockchain is nowadays used across many industries. Their main similarity is that they all benefit from Blockchain’s properties like immutability and transparency. Here is how Blockchain improves businesses in specific industries:

- Supply chain: suffering from prolonged and heavy paper trails, the supply chain industry benefits from Blockchain by removing the need for all participants to have copies of everything. With a single, immutable source of information, data reconciliation becomes much faster and eliminates the need for any unnecessary third parties.

- Insurance: another case in which data reconciliation is essential, Blockchain allows all participants to see what was done by whom. This prevents insurance fraud and speeds up all processes.

- Banking: Blockchain allows for faster and more efficient cross-border payments but adds a new layer of transparency and accountability to traditional finance. This is why many banks are looking into their own central bank digital currencies (CBDCs).

- Healthcare: the coronavirus pandemic has proven a need for accessible healthcare information. Using Blockchain, users can decide who to share their information with, which includes vaccination status, whether or not they’ve had Covid, and if they are at risk—all information that can help them lead a more normal life, like going to concerts and events, if they’re healthy.

- Pharmacy: pharmaceuticals are often counterfeit and sold on black markets, which can be extremely dangerous. Tracking an item from manufacturing to end-user helps prevent that and check for expiration.

- Government: voter fraud is a globally widespread issue that Blockchain can help combat. This is why many countries are looking into implementing a blockchain-based voter system that cannot be manipulated in favor of any party to facilitate a genuinely democratic process.

- Gaming: Like art, NFTs take ownership to an entirely new level, so collecting games is thriving thanks to the technology.

Common Myths About Blockchain

Blockchain is followed by some pervasive myths perpetrated by a lack of understanding. Here, we will take a look at them and explain the truth.

- Bitcoin = Blockchain: One of the most common myths assumes that Bitcoin and Blockchain are the same. As we’ve already covered, the two originated together, but Blockchain has found many other use cases.

- Blockchain uses a lot of electricity: This is true of PoW consensus algorithms; blockchains that use other consensus mechanisms do not spend more electricity than many other technologies.

- Blockchain is slow: Bitcoin transactions are much slower than other fiat payment processors due to its set block time. Many other blockchains are much faster, even processing thousands of transactions per second.

- Blockchain isn’t mature enough for the mainstream: Many enterprises are already using Blockchain—Forbes has an annual Blockchain 50 list, showing businesses with a revenue of more than USD 1 billion per year.

- All my transactions are publicly visible: Despite this, identifying you will prove difficult as long as you employ even the most fundamental privacy safeguards.