Privacy Coins: Are They Really Anonymous?

Privacy Coins: Are They Really Anonymous? Digital currencies’ anonymity through decentralized transactions and associated services is highly regarded. Thousands of cryptocurrencies with features similar to Bitcoin (BTC) have been produced since its introduction in 2009. These digital currencies may be anonymous and decentralized but are not completely private. For instance, the Bitcoin blockchain records the transaction between Bob and Alice, wherein Bob sends Alice 1 BTC without revealing personal information about either party. Anyone with knowledge of Alice and Bob’s wallet addresses can access records of their Bitcoin transactions. Hence, the strategy makes the transaction pseudonymous, not anonymous.

Similarly, a blockchain explorer such as Ethereumscan makes it easy to trace the purchase and sale of every Ethereum token. Knowing a user’s wallet address also grants access to their transaction history and crypto holdings. Because of this, the concept of privacy coins—cryptocurrencies that cannot be traced—was born. This article explores privacy currencies’ functionality, legality, and the top ten privacy coins by market cap.

What are Privacy Coins?

To be anonymous online, you should look into privacy coins and digital assets that hide your on-chain transactions. Their primary purpose is safeguarding users’ private information and identity while conducting financial transactions. Using privacy-enhancing technology like zero-knowledge proofs and stealth addresses is a key aspect of privacy coins. Using a stealth address, you can create a new, one-time address for every transaction, making it harder for other blockchain users to associate the transaction with a particular user. However, with zero-knowledge proofs, you can demonstrate ownership of specific data without disclosing it.

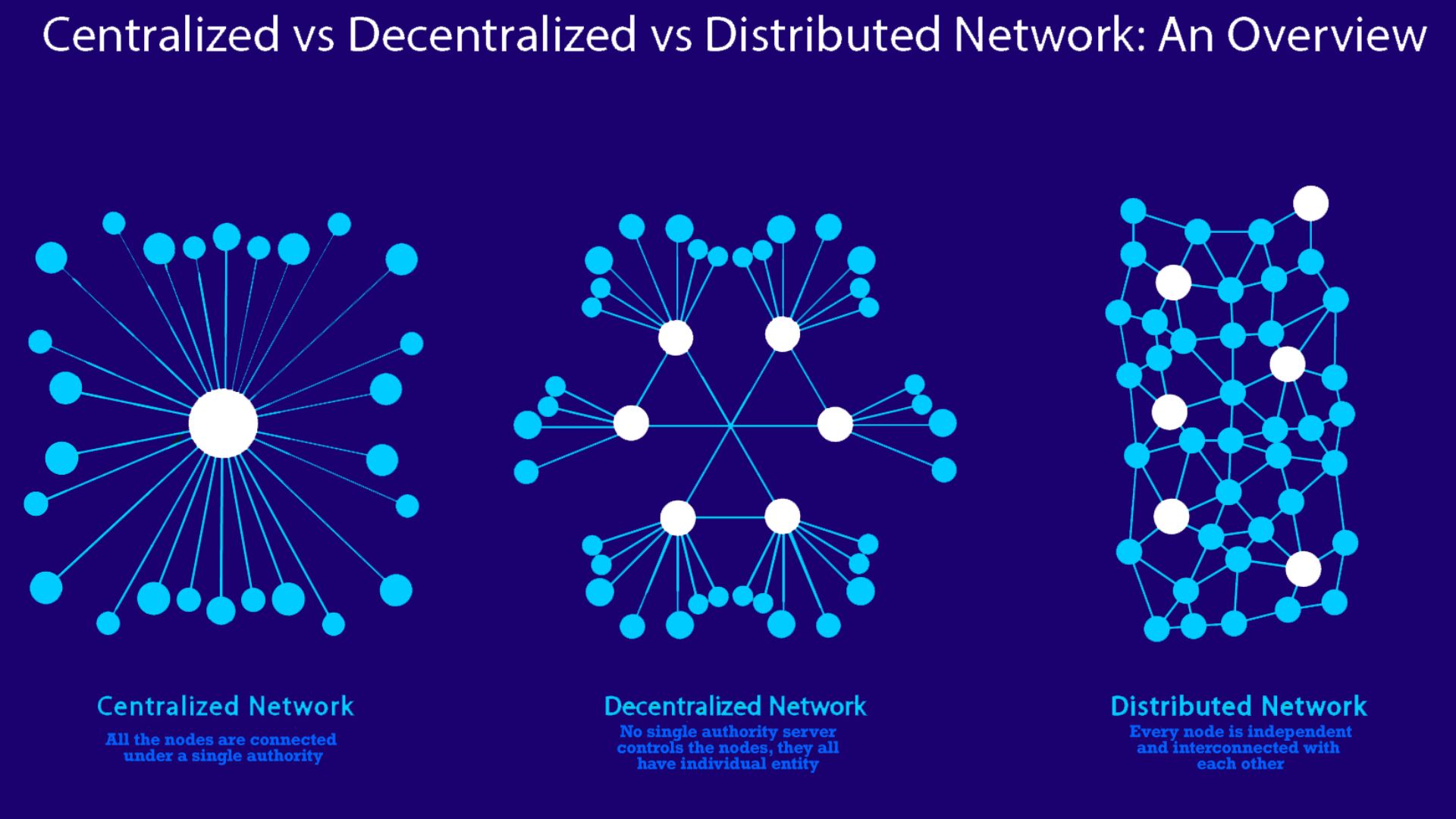

Dash (DASH), Monero (XMR), and Zcash (ZEC) are a few of the most well-known privacy coins. To hide who sent and received a transaction, Monero, for instance, uses ring signatures and stealth addresses. To demonstrate the integrity of a claim without disclosing its foundational data, Zcash employs a mechanism known as zk-SNARKs, which stands for Zero-Knowledge Succinct Non-Interactive Argument of Knowledge. Dash employs a decentralized “masternode” network to hide the origin of its transactions.

Law enforcement and regulatory organizations have lauded and criticized privacy coins for their respective roles in safeguarding users’ personal information. Some have voiced concerns that they could be utilized to smuggle in illicit goods or launder money. This has led several governments to crack down on or outright prohibit privacy coins. Despite the backlash, privacy coins are becoming popular among crypto users who are concerned about data breaches and want a way to keep their private information safe. Your priorities and level of comfort with risk should guide your selection of the usage of privacy coins.

Are Privacy Coins Legal?

Using privacy coins is usually not against the law. Nevertheless, the legal standing of these currencies differs from one jurisdiction to another. The usage of privacy coins may be subject to rules and regulations in some nations but not others. Countries with stringent anti-money laundering (AML) legislation or governments that have voiced worries about the potential misuse of privacy coins for illegal activities, such as the United States, may have more stringent regulations regarding their use. Using privacy coins for everyday activities without planning to avoid taxes or participate in unlawful transactions may still be considered illegal in some nations.

However, privacy coins are not as strictly regulated in crypto-friendly or less stringently regulated nations like El Salvador and Malta. Using privacy coins for everything from making purchases and investments to sending money to other people in these countries is perfectly legal.

Remember that privacy coins may still be subject to other restrictions, such as those on money transmission or tax evasion, even in nations where their use is not specifically regulated. The place of privacy coins in the law is complicated and dynamic. Due diligence necessitates familiarity with the rules and regulations governing their utilization in your jurisdiction.

How Do Privacy Coins Work?

Users can stay anonymous and private with privacy coins because they use various strategies. Remember that these methods aren’t infallible and might not give you complete anonymity, but they can hide your on-chain traces and identify quite well. Because of this, you should only utilize privacy coins for legitimate purposes; otherwise, law enforcement will find out if you abuse them.

A privacy coin’s first tactic is known as “mixing.”The process utilizes a neutral third-party service, called a “mixer,” like Tornado Cash, to disrupt the chain of custody for a transaction. Instead of sending Bitcoin or any other cryptocurrency to another user, you can use the mixing service powered by smart contracts. To further obscure the sender’s identity, the mixing service may employ strategies like rearranging the coins in its liquidity pools or employing a network of intermediary addresses. Because of this, it’s nearly impossible to determine who sent or received the money.

Another popular method for privacy coins is using “stealth addresses.” It makes use of a randomly generated address for every transaction. The beneficiary of the transaction creates the stealth address; it is not associated with their address. Anyone will have difficulty tracing the transaction after you transmit any coin to the stealth address.

Users can stay anonymous on privacy platforms using various strategies, including stealth addresses, ring signatures, and zero-knowledge proofs. It isn’t easy to ascertain which group member executed a certain transaction using ring signatures because many users can use the same address. At the same time, zero-knowledge proofs can conceal your identity and transaction details while proving the truth of a statement.

Can Privacy Coins be Tracked?

One thing to remember is that privacy coins aren’t completely anonymous. They do a better job hiding your identity than most cryptocurrencies, but they aren’t completely anonymous. For instance, Monero’s use of ring signatures to mask the sender’s identity is flawed and susceptible to attacks that could expose your true identity. If contractors could develop methods to help trace monero, the US Internal Revenue Service (IRS) would pay them $625,000 in September 2020. Chainalysis and Integra FEC were the recipients of this contract. A leaked presentation said Chainalysis could find a “usable lead” in 65% of cryptocurrency tracing scenarios.

Money laundering charges involving $4.5 billion in stolen bitcoin were leveled against Heather Morgan and Ilya Lichtenstein in early 2022. To evade detection, they swapped Bitcoin for privacy coins such as Dash and Monero, in addition to employing additional obfuscation strategies like mixers. Nobody knows how or whether authorities tracked Monero’s activity to connect the accounts to the crooks, but it’s still possible.

Though some privacy coins may be traced, not all can, and the efficacy of tracking methods differs from coin to currency and method to method. While certain privacy coins may be easier to trace than others, future innovations in technology and methods may render them even more mysterious. Even while privacy coins provide more anonymity than other cryptocurrencies, it is still possible to track them. Although the degree to which these coins can be traced varies with each denomination and the procedures employed, it is possible.

List of Top 10 Privacy Coins

Have you ever wanted to know which privacy coins are currently trending? For your convenience, we have compiled a list of several prominent privacy currencies now available.

Monero (XMR)

The 2014 creation of Monero’s XMR coin prioritized anonymity and privacy. Its market worth of $2.6 billion makes it the largest privacy currency. The XMR network records transactions in a public ledger using a proof-of-work (PoW) technique. An important aspect of Monero is the use of ring signatures, a method for hiding the identity of the people involved in a transaction.

Users in a ring can sign documents using a single public key while maintaining their private keys. To ensure the legitimacy of a transaction, the sender might conceal the private key used to generate the signature by using the shared public key. Monero employs stealth addresses and secure transactions to take user privacy even further.

Zcash (ZEC)

An open-source, decentralized cryptocurrency that prioritizes user privacy through cryptography is ZEC. An estimated $0.5 billion in market capitalization makes it the second most valuable privacy currency. With the implementation of zero-knowledge proofs, a privacy feature, ZEC split apart from the Bitcoin system in 2016.

In zero-knowledge proofs, one can show another that a proposition is true without disclosing any information. While using Zcash, you can send and receive ZEC anonymously, regardless of the quantity or your identity. Although all ZEC transactions are recorded on a public blockchain, the sending and receiving parties and the amount of ZEC are encrypted, making them unintelligible to anyone else.

Dash (DASH)

DASH is a cryptocurrency that aims to enhance Bitcoin’s functionality. Quick, cheap, and anonymous transactions are available with this open-source cryptocurrency. With a market cap of $0.47 billion, it ranks as the third biggest privacy currency. Dash employs a method known as PrivateSend to ensure user anonymity. One way PrivateSend makes it hard to trace the origin of money is by combining several transactions of the same amount. Furthermore, Dash offers a function called InstantSend that enables confirmation of transactions to occur very instantly, eliminating the need for several confirmations.

Decred (DCR)

DCR is a privacy coin that lets users decide how the protocol is developed and directed through a decentralized governance mechanism. It employs the Proof-of-Work (PoW) technique to verify transactions and add blocks to the blockchain derived from the Bitcoin source. DCR is worth $0.28 billion on the market.

A mixing technique called CoinShuffle++ (CSPP) is available to Decred users as an alternative to hide their ownership of DCR coins. Using a mixer to anonymize the output addresses, there is no way to tell which coins are in which wallets. However, the reuse of wallet addresses or improper usage of change outputs can compromise this anonymity.

Beldex (BDX)

One such decentralized exchange (DEX) is Beldex, which aims to facilitate the purchase and sale of digital assets safely and anonymously. The Monero blockchain, which provides strong privacy protections, is its foundation. To ensure user privacy, Beldex employs stealth addresses and ring signatures. There is $0.18 billion worth of BDX coins on the market.

Mask Network (MASK)

To ensure the privacy and anonymity of its users, Mask Network employs encryption in its open-source, decentralized network. Mask Network members can encrypt their social media posts and even communicate using cryptocurrency through these platforms. Asymmetrical encryption allows the sender to encrypt content using their private key and the recipient to decrypt it using their public key. The Ethereum blockchain serves as its foundation. The fact that no central authority is involved safeguards users’ privacy. About $0.15 billion is the value of MASK on the market.

DigiByte (DGB)

In 2014, Jared Tate launched DGB, a cryptocurrency that operates decentrally. Its foundations are in the Bitcoin and Litecoin protocols, but it boasts improvements like more robust security and quicker transaction times. DGT is worth $0.13 billion on the market. “Dandelion++” is a privacy-enhancing tool for the DigiByte blockchain that DigiByte utilizes. It conceals the sender’s IP address. Because of this, DigiByte is safer since the sender’s identity remains hidden.

Secret (SCRT)

A platform that prioritizes data privacy and anonymity is Secret Network (SCRT). To ensure that no one can access the personal information of the people participating in private smart contracts, Secret provides them with encrypted inputs and outputs. By hiding wallet activity and account balances, we can prevent front-running attacks, in which an attacker bets on a wallet’s massive buy or sale. Users must own SCRT to access the Secret Network. SCRT is utilized for staking and governance and is required to pay network costs.

NuCypher (NU)

Threshold Network results from a merger of NuCypher and the KEEP Network. NuCypher is an open-source, decentralized technology that allows secure, privacy-preserving communication and storage of private data on a public blockchain. A proxy re-encryption service lets users manage secrets and dynamically regulate access to sensitive data.

Horizen (ZEN)

Sending and receiving private transactions is made possible via Horizen, a privacy protocol. Its previous name was ZenCash. To remain anonymous, Horizen employs zero-knowledge proofs. This method checks the legitimacy of a transaction without disclosing any information about the transaction’s sender, receiver, or amount.

Conclusion

Finally, while privacy coins provide great anonymity and privacy, they also threaten those who would use them for illicit purposes. Consequently, they have encountered difficulties with regulations and have been the subject of controversy; for example, the Tornado Cash incident led to the US sanctioning the protocol on suspicion of laundering cybercrime proceeds.

You are responsible for verifying the legality of privacy coins in your jurisdiction before you use them. You shouldn’t regard this post as investing advice; it’s just for informative reasons.